Remember Blair Waldorf thinking she had fashion figured out until she got to Paris?

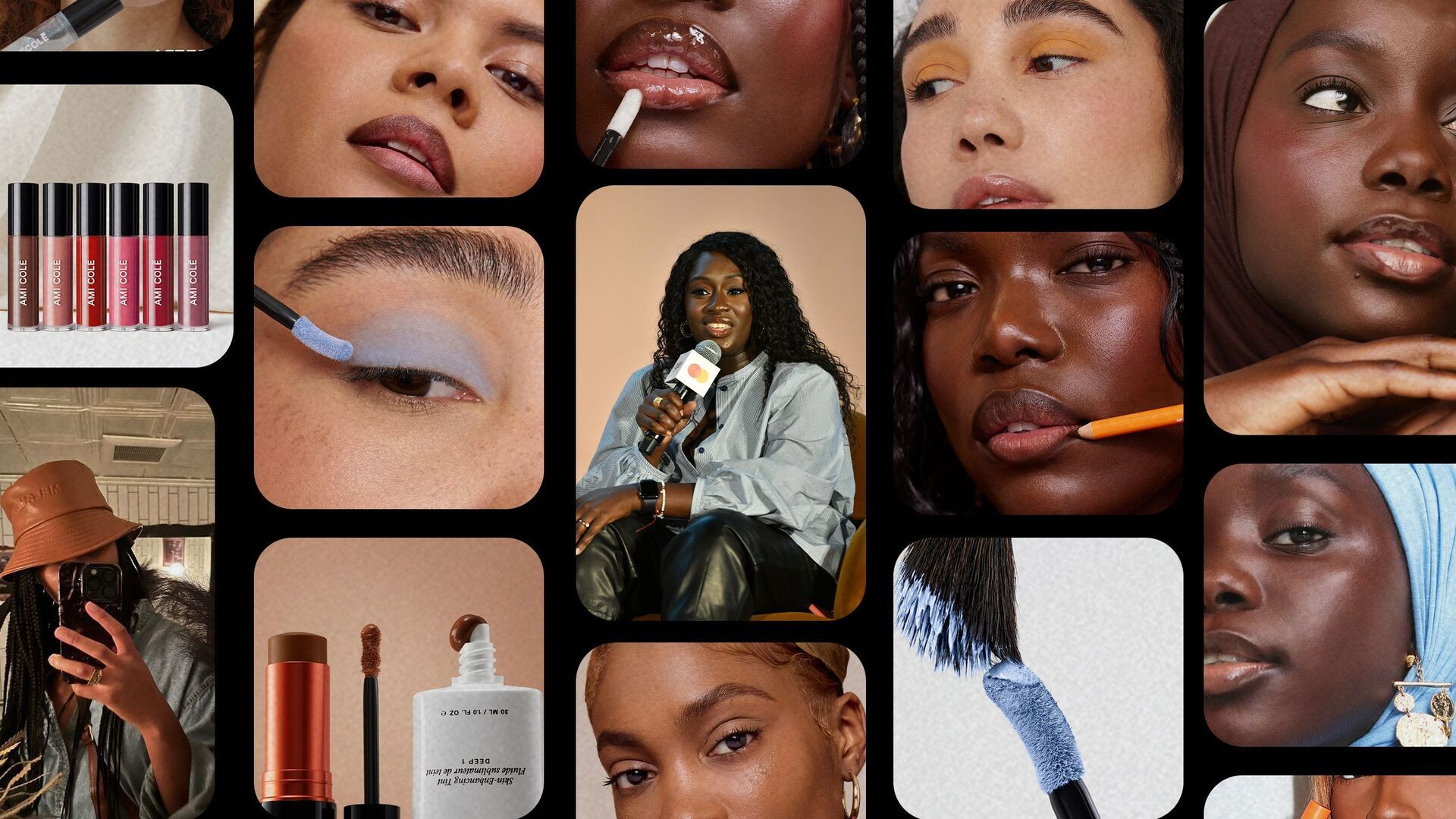

That's what watching Ami Colé close feels like. All the right moves - $3M raised, 600 Sephora doors, loyal fanbase - and still not enough.

Sometimes success isn't actually success at all.

Upcoming

On agenda today:

Why Ami Colé really closed (it's not what you think) 💔

The 3 operational gaps that kill funded beauty brands 🚨

Scripts for saying no to investors who push bad growth 💪

Alternative scaling that actually works 📈

Time to decode what keeps funded founders alive

POWER WOMEN WRITING CHECKS

Unilever Ventures €250M fund backing sustainable consumer brands. They understand retail operations and have infrastructure to support smart scaling.

Female Founders Fund

$275M specifically for women-led ventures. Portfolio includes brands that scaled methodically - Billie, Supergoop, Prose.

Astia Angels 450+ angel investors focused on female founders. Many are former beauty executives with retail partnership experience.

These aren't just investor names - they're operational partners who understand female founders need different support.

Hot Take

📉 Post-DEI drop: Only 0.4% of VC funding went to Black founders in 2025 (lowest in years)

💰 Female founder penalty: Women who fail raise 53% less capital next time vs. men

🏪 Beauty battlefield: 25% of beauty brands fighting for same shelf space

💸 Cash flow crisis: 40% of beauty brands that hit major retail run out of money within 18 months

My take: The Ami Colé story isn't about one brand failing. It's about a funding system that pushes female founders to scale fast instead of scale smart.

When Success Becomes the Problem 💔

Here's the uncomfortable truth: Having all the "right" metrics doesn't guarantee survival.

Diarrha N'Diaye had everything investors want. Awards. Community. Retail partnerships. $3M+ raised.

But like Cher learning that popularity doesn't equal happiness, external validation doesn't equal sustainable business.

"I rode a temperamental wave of appraising investors instead of focusing on our loyal fan base." - Diarrha's reflection on what went wrong.

The Three Operational Killers

1. The VC Pressure Trap Post-2020, DEI funding disappeared. Instead of doubling down on customers who were buying, Diarrha spent energy "performing for investors."

2. The Sephora Scale Disaster

600 doors sounds impressive.

Reality: massive upfront inventory costs with zero sell-through guarantee. One viral moment followed by products sitting on shelves = cash flow death.

3. The Team Gap Crisis Her "day zero team" couldn't handle $10M operations or Sephora's complex margins. Retail scale requires different skills than bootstrapping to traction.

The Secret Sauce

Don't let investor meetings drive strategy over customer needs.

The beauty brands winning now have strong operations and diverse revenue streams, not just big launches.

Why This Matters Now Beauty funding dropped 34% this year.

Investors want operationally mature businesses, not just growth stories.

You need different skills for scale than for traction.

How I can help you this week:

🎯 Share your scaling story: Reply with a growth opportunity you're considering - should you take it or pass? ✨

Connect with me on LinkedIn for daily funding reality checks.

Next week: Building investor relationships without performance pressure. What scenarios should I cover? 📩

That’s it for this week.

Success isn't about hitting every milestone investors want. It's about building something that survives the journey.

Talk soon,

OnAgenda Team

P.S.

Fun fact: A founder just turned down Target to focus on profitability first. Six months later, they came back with better terms. Sometimes saying no to "success" is the smartest move. 💪